Emma, the money management app, has launched in the US and Canada.

This comes after the money management app partnered with Plaid in the US, the leader for account aggregation.

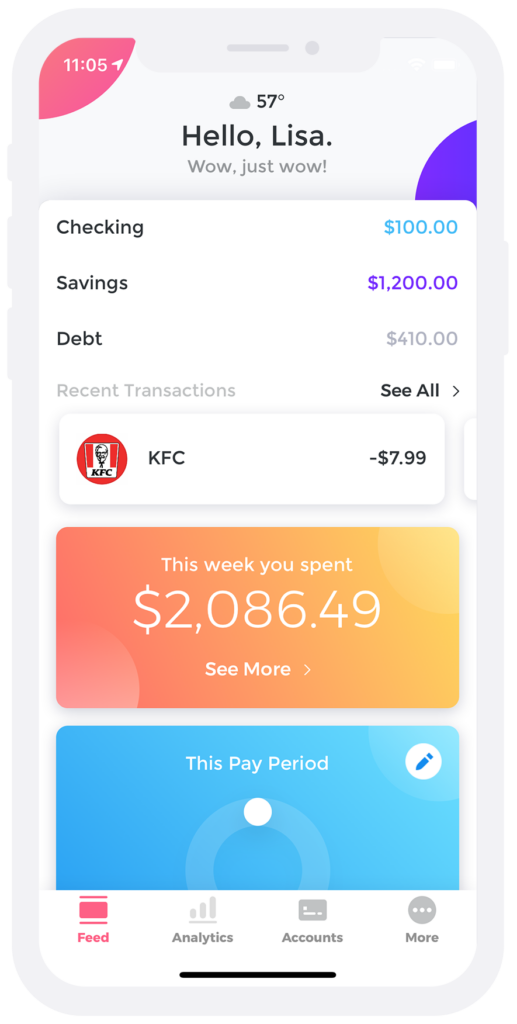

Emma is a “financial friend” that lets users budget, track spending, and save money.

Based in London, Emma launched in January 2018 with a team of finance and technology experts. The company raised a seed round of $700,000 in July 2018 led by Kima Ventures, one of the first investors in Transferwise, and Aglaé Ventures, the early stage programme of the Groupe Arnault, investor in Netflix and Airbnb.

In the first year since launch, Emma garnered over 100,000 downloads. Users open the app five times a week, and twice daily, on average.

In March 2019, Apple featured Emma as “App of The Day” on the UK App Store, making it the most downloaded finance app of the week.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataEdoardo Moreni, CEO and co-founder of Emma, said: “Emma was built to empower millions of individuals to live a better and more fulfilling financial life. The UK was the best place to start and iterate in order to build the first finance app in the world.

“However, we are now ready to take the company a step further in order to achieve our mission faster. That’s why we are launching Emma in the US and Canada.”

Money management is in vogue at the moment. Artificial Intelligence (AI)-powered personal money management chatbot Plum has raised $4.5m in a new funding round led by VentureFriends and the EBRD.

The latest funding round raises the fintech firm’s total funding to $6.3m.

Following the investment, Plum has expanded its engineering teams in London and Athens. The funding also helped it to pursue its multi-platform strategy.

In Canada, RBC launched NOMI Budgets.

The AI-powered solution is accessible through the RBC mobile app. It will support customers in keeping track of their finances and help them budget.

RBC NOMI Budgets harnesses the power of AI to precisely analyse a customer’s spending history and behaviour. By doing this, RBC can make tailored recommendations on a budget that would work for each individual user.