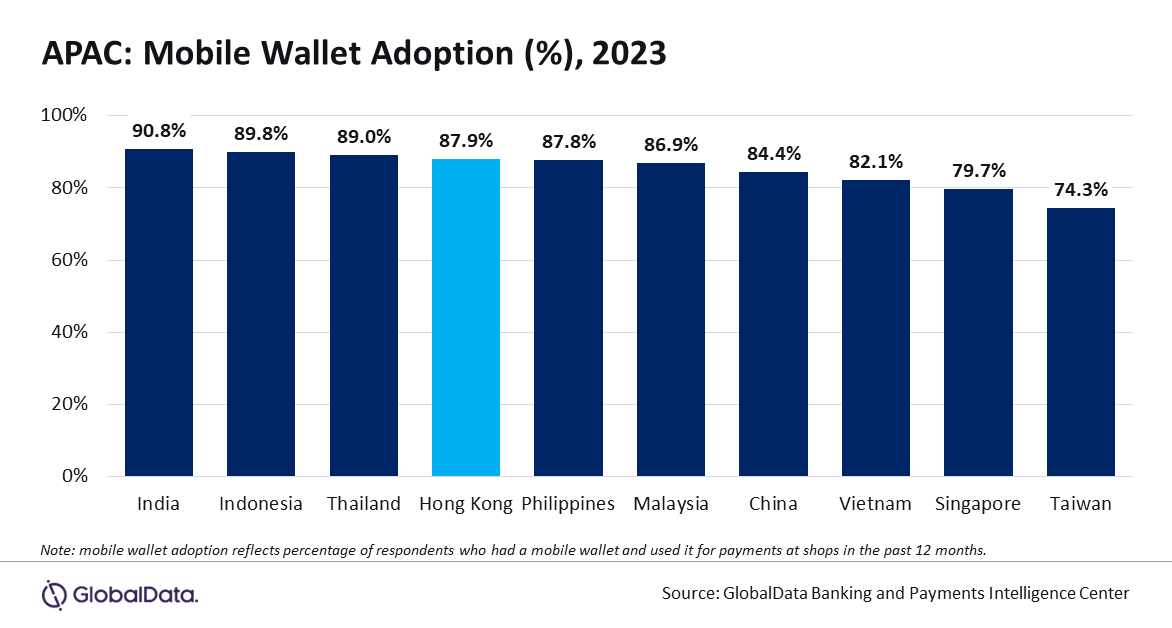

Mobile wallet usage is on the rise in the Asia-Pacific (APAC) region, a trend that is prevalent in Hong Kong (China SAR) as well, with nearly 88% respondents using mobile wallets for payments at shops, according to GlobalData, publishers of EPI.

GlobalData 2023 Financial Services Consumer Survey

GlobalData’s 2023 Financial Services Consumer Survey shows that Hong Kong ranks fourth globally in terms of mobile wallet adoption with 87.9% survey respondents indicating that they had a mobile wallet and used in a shop in the past 12 months. The Covid-19 pandemic also accelerated mobile wallet adoption as consumers shifted from cash to electronic payments.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, said: “Mobile wallet usage is all set to disrupt the consumer payments space in Hong Kong and gradually displace cash. Widespread QR code infrastructure, the availability of mobile-based instant payment systems, and rising consumer and merchant preference all contributed towards mobile wallet usage.”

While cards remain the preferred non-cash payment instrument, the rise in mobile payments is evident. The country’s strong adult banked population and smartphone penetration; the availability of mobile wallets including domestic and international brands such as Octopus Wallet, AlipayHK, Apple Pay, and Google Pay; and growing merchant acceptance are driving the number of potential mobile wallet users.

AlipayHK is one of the Hong Kong’s most prominent mobile wallet brands with 3.3 million users and a merchant base of 150,000, as of May 2024.

Hong Kong has been investing in building infrastructure for mobile wallet payments, with Hong Kong Common QR Code (HKQR) code being one such initiative. To further encourage digital payment acceptance, the Hong Kong Monetary Authority (HKMA) rolled out common QR code standard (HKQR), thereby eliminating the need for merchants to display multiple QR codes and thus encouraging the use of QR codes for payments.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFPS: supported by 36 banks and 10 payment services providers

The introduction of real-time (instant) Faster Payment System (FPS) complimented HKQR in driving the mobile wallet adoption and usage. In addition to facilitating real-time fund transfers between bank accounts, FPS supports QR-code based merchant payments. As of May 2024, 36 banks and 10 payment services providers support FPS.

Sharma added: “Mobile wallet has become a mainstream payment solution in Hong Kong, driven by the government push, supporting payment infrastructure, and the proliferation of mobile wallet brands. With smartphones being integral to everyday life in Hong Kong, and consumers becoming more comfortable utilising mobile phones for making payments, this space is likely to record further growth going forward.”