The card reigns supreme in Norway, with few individuals using cash on a daily basis, and most possessing a minimum of three payment cards.

Norway’s strong cards and payments industry is the result of a robust economy, an efficient domestic debit card scheme in BankAxept, and a high banked population. The average number of monthly card transactions and the average annual spend per card are higher in Norway than in other developed markets such as the US, Italy and Germany.

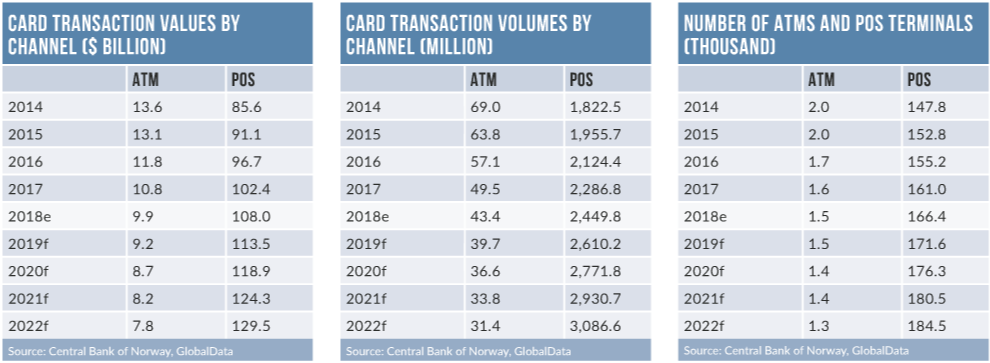

Electronic payments have gained ground during the last 10 years, as the government has invested substantially in building long-term infrastructure for cashless transactions. Affordable and widely available financial products, a strong presence of digital-only banks, consumer preference for e-payments, a competitive market and a transparent business environment will aid the move towards a cashless society.

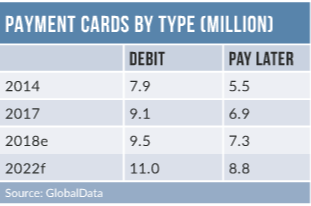

Frequency of debit card payments in Norway stood at 230.8 in 2018 – one of the highest in the world. High use of debit cards is mainly a result of a growing preference among Norwegians for cashless payments.

Higher fees on ATM withdrawals have also pushed debit card use, a trend that is also supported by BankAxept’s zero-interchange- fee model, which enables merchants to accept debit cards at lower cost. The introduction of contactless debit cards in June 2017, and moves in 2018 to support online payments by BankAxept will further push debit card use for payments.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataPay-later cards accounted for just 18.3% of the total payment card transaction value in 2018. Although there is a high penetration of pay-later cards, their use remains stubbornly low, mainly due to the debt-averse nature of Norwegian consumers and the high popularity of the local debit card scheme.

However, pay-later cards have registered strong growth in terms of transaction volume and value, supported by a growing e-commerce market and increased overseas spending. According to GlobalData’s 2018 Consumer Payments Insight Survey, credit and charge cards together accounted for 40.2% of total e-commerce transactions by value in 2018.

E-commerce in Norway registered robust growth from NOK65bn ($7.9bn) in 2014 to $14.6bn in 2018, at a CAGR of 16.5%, mainly supported by high internet and smartphone penetration. Many retailers are increasingly focusing on e-commerce; for example, German fashion retailer Bonprix launched an online store in Norway in August 2017. The availability of alternative payments including PayPal, Vipps, Masterpass, Klarna and paysafecard are also expected to support e-commerce.

Digital banks are increasingly making their way to Norway. Malta-based mobileonly Ferratum Bank launched operations in the country in 2016