Cash remains the predominant payment instrument in Indonesia – especially among the rural population – accounting for 98.3% of the total transaction volume in 2018.

This is mainly due to the high unbanked population, inadequate banking infrastructure, limited public awareness of electronic payments, and low acceptance of payment cards at merchant outlets. However, the government has taken initiatives including a National Strategy for Financial Inclusion, the appointment of banking correspondents in rural areas, the migration of payment cards to EMV standards, compulsory use of electronic payments for toll road payments, and the launch of a National Payment Gateway.

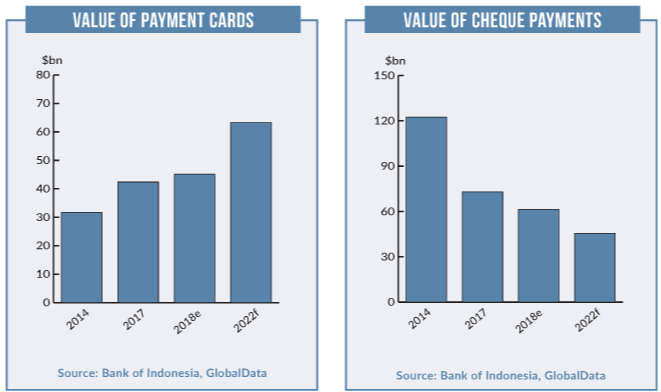

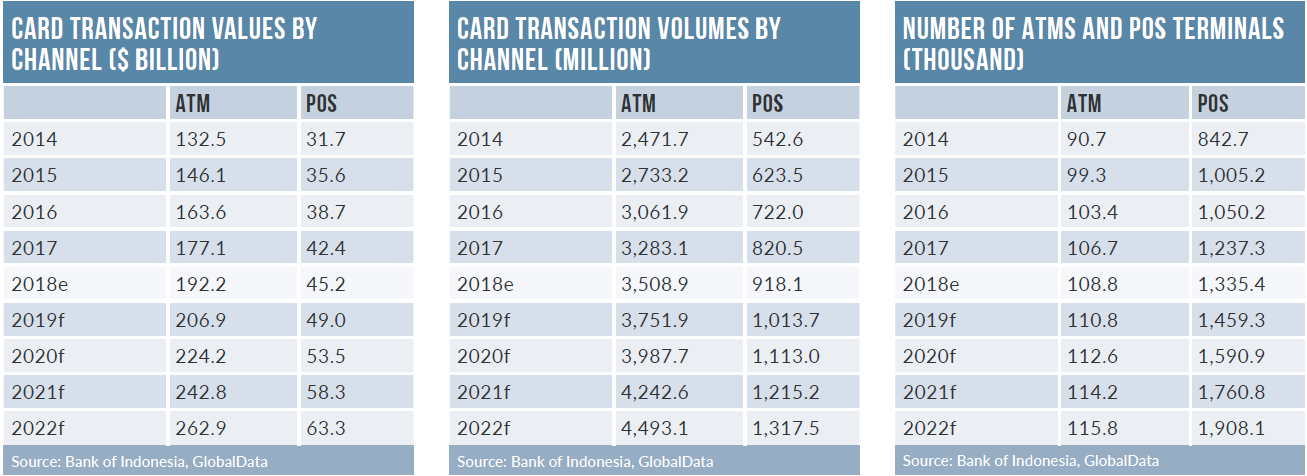

Consequently, the number of payment cards in circulation, transaction volume, and transaction value recorded robust CAGRs between 2014 and 2018 – a trend that will continue over the next five years. The emergence of contactless technology and growth in e-commerce are also expected to support payment card market growth.

Rising investment in POS infrastructure and the proliferation of new payment solutions will further push electronic payments. Debit cards remain the preferred card type among Indonesian consumers. The government and commercial banks have taken initiatives to bring people into the formal banking system, resulting in the banked population rising from 36.1% in 2014 to 52% in 2018.

Debit card use is mostly restricted to ATM cash withdrawals, with frequency of use six times higher than that of payments. This is primarily because both consumers and merchants still prefer cash; however, as the government improves the cardacceptance infrastructure, debit card payments are gaining ground.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataPay-later cards account for a small proportion of the payment card market, with overall penetration at just 6.6 cards per 100 individuals in 2018. Strict government regulations on credit card eligibility remain a key reason for the low penetration. The minimum monthly income to apply for a credit card in Indonesia is IDR3m ($221.05).

The number of credit cards held and the credit limit depend on the individual having a monthly income of between $221.05 and $736.82. In December 2017 the central bank required all credit card issuers to submit transaction details to the Tax Office. E-commerce in Indonesia posted a significant CAGR of 47.5%, rising from $2.95bn in 2014 to $13.95bn in 2018.

Improvements in mobile penetration, consumer confidence in online transactions and foreign investment, and the presence of secure online gateways have driven growth in the Indonesian e-commerce market, as has the presence of alternative solutions such as PayPal, Doku Wallet, iPayMu, and BBM Money.