The key indicators of an impending US recession are pointing to one within the near future, according to a new report.

It comes after earlier this year the Federal Reserve System dropped the US recession forecast from the table. There are repeated discussions by economists and financial speculators regarding whether the US economy is headed for a hard or soft landing and if the recession window is closing.

The History (and Future) of Recessions report, written by Deutsche Bank’s head of global economics and thematic research Tim Reid, provides a long-reaching historical analysis of recessions across the G7, with insights into what indicators should be monitored to forecast recessions.

It identifies four key macroeconomic indicators that signal an impending recession: monetary tightening, yield curve inversions, oil price spikes, inflation increases and government budget deficit decline.

Reid’s report states that, although a US recession is not certain, “the macroeconomic ingredients are in place, consistent with previous recessions through history“. These have been identified as:

- Inflation increasing 3pp over a rolling 24-month period;

- The yield curve inverting;

- Short-term rates increasing 1.5pp over a rolling 12-month period, and

- Oil increasing +25% over a rolling 12-month period

Commenting on other potential indicators, chief US economist at TS Lombard Steven Blitz adds: “Employment is a lagging indicator. Usually, that is the signal that a recession has begun … Private sector employment, excluding retail, health and restaurants is almost negligible. So that is telling us that we’re getting close. We’re not there yet.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData’s monthly economic forecast from September echoes Blitz’s comments, stating the US “unemployment rate registered a significant uptick by 0.3 percentage points to 3.8% during August 2023, reaching its highest level since February 2022.”

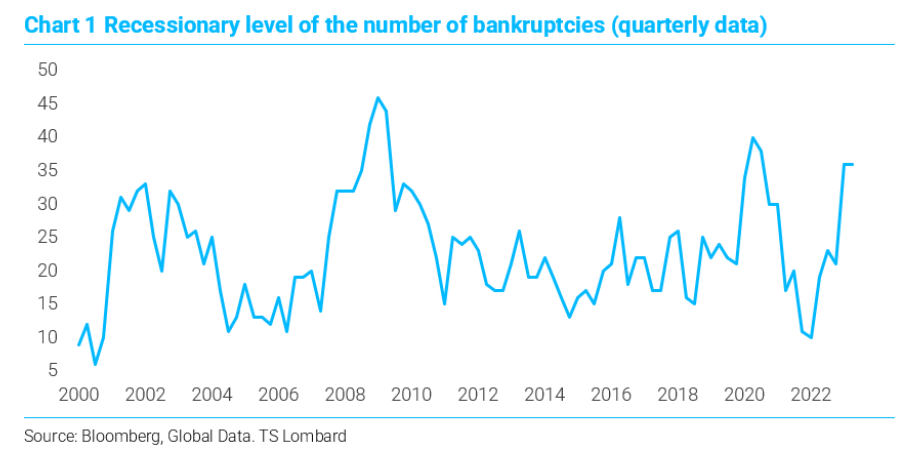

Blitz’s US Watch: Is the recession window closing report from earlier this year highlights that, as well as keeping an eye on GDP, the number of bankruptcies can also signal something is awry. Data from the first half of 2022 shows bankruptcies to be on the rise, reaching a peak close to pandemic levels.

Concerning the relation between US monetary tightening and the probability of recession, Deutsche Bank’s report states: “Over the last 170 years, when US short-end rates have risen by either 1.5pp (12-month rolling) or 2.5pp (24-month rolling) there has been a recession within 36 months between 69-74% of the time.”

It also notes that, of the countries surveyed in the report, the US seems to have the most sensitivity to interest rates.

While indicators are flashing and we may witness contraction in the US Economy, Blitz adds that we are not expecting a deep crisis, stating: “I would expect a mild recession, unemployment over 5% and a 1% peak to trough drop in real GDP” – not something of the same magnitude as the 2008-9 crisis, as those sorts of economic shocks are more unpredictable. Macroeconomic crises have become less frequent.

Over the last 40 years, Deutsche Bank has found that, since 1982, only 8% of that time has been spent in recession in contrast to 35% pre-1982. The report went on to state that we have been “statistically lucky” in terms of minimal external shocks in the global economy.

Presently, GlobalData’s monthly economic forecast projects the annual inflation growth for 2023 for the US to be 4.1% and the real GDP growth forecast at 2.0%, showing modest economic growth for the US.