Cash dominates the Mexican payments landscape, accounting for 89.5% of the overall transaction volume in 2018.

With government and central bank initiatives, growing consumer awareness, and a gradual rise in card acceptance, Mexicans are gradually shifting towards electronic payments. The central bank and financial institutions have taken steps to raise financial inclusion, such as offering insurance cover on deposit accounts, and making basic and payroll accounts available.

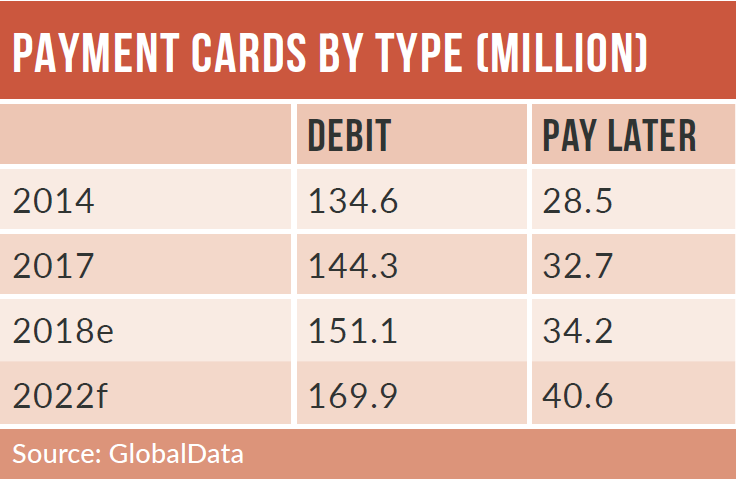

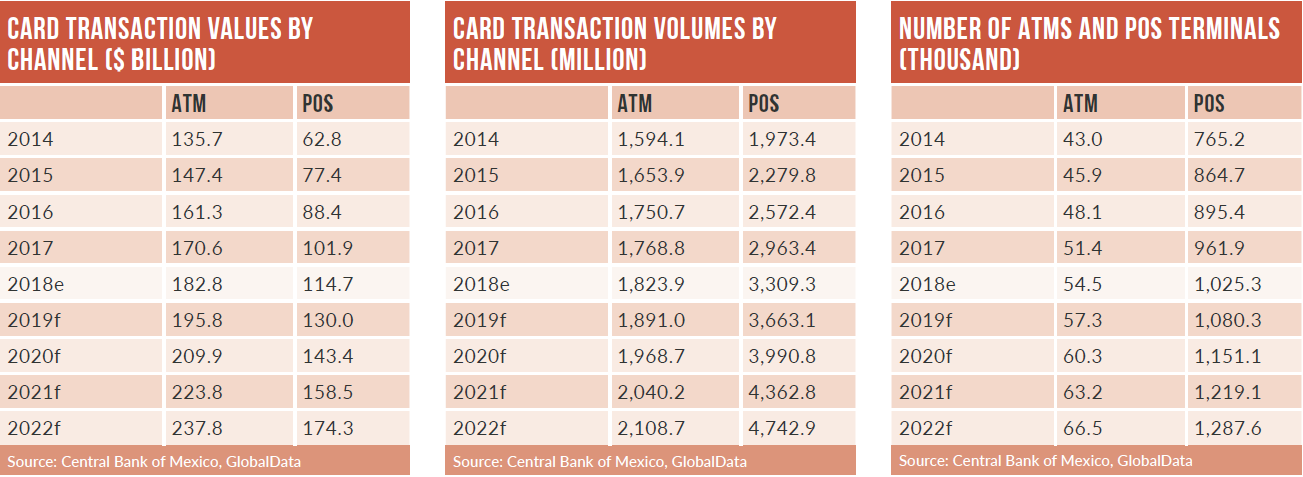

To increase merchant acceptance, the central bank has capped interchange fees on debit and credit card transactions, while banks are cutting merchant discount rates. Debit cards have higher penetration, but are mostly used to withdraw cash; paylater cards are more frequently used for payments.

Contactless cards and mobile proximity payments are not widely used in Mexico, although major banks have made attempts to increase their adoption. The government ran the Savings and Credit Sector Consolidation and Financial Inclusion Project between 2012 and 2017. The project provided financial education initiatives to 1.8 million individuals and encouraged Mexicans to open new deposit accounts – with a total of 9.5 million members insured by deposit insurance in 2017, compared to 6.1 million in 2011.

The number of service points for members of social bank Bansefi tripled from 1,800 in October 2011 to 5,600 in July 2017. Meanwhile, the number of banking agents increased from just 95 in 2011 to 2,496 in July 2017. The Mexican banking and payments system operates a very different model from its peers, with convenience stores forming an integral component.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFor instance, Banamex partners with Oxxo, the largest convenience chain in Mexico, to supply its co-branded Saldazo debit cards through 14,000 stores. As of December 2017, over 9 million Saldazo debit cards were issued through Oxxo stores.

Similarly, in October 2017 Amazon introduced a cash payment service, enabling Mexicans to load Amazon account balances at 7-Eleven stores. Mexico has the largest e-commerce market in Latin America, which recorded significant growth between 2014 and 2018, supported by rises in internet and smartphone penetration, consumer confidence and the number of retailers entering the online space.

Online retailers are also offering cards for shopping purposes. In March 2018, Amazon introduced a Mastercard-branded Amazon Rechargeable prepaid card, which enables users to load money at convenience stores such as 7-Eleven, and can be used for Amazon purchases.

The prepaid card market, though nascent, has grown at a moderate pace in the last five years, at a CAGR of 6.6% in terms of transaction value.