A number of high profile fintechs were in job cutting mode in 2023. Jobs were shed across the Australian-based failed and failing BNPL outfits as 12 listed outfits shrank to just two. Elsewhere, Coinbase kicked off 2023 with almost 1,000 job losses. PayPal shed around 7% of its global workforce, around 2,000 roles soon after. Crypto firm BitWise lost around 900 roles in May while N26 shed around 4% of its staff or 70 jobs and BaaS platform Synapse cut 40% of its FTEs in the fourth quarter. WorldRemit owner, the fintech Zepz was also in the news as it axed 400 roles, about 25% of its workforce.

Stripe and Plaid had rather led the way with job losses of 1,000 and 260 respectively.

Job losses even extended to Thought Machine. Only a few months after it announced plans to grow headcount from 550 to 675, it was reportedly planning to shed around 50 staff in the fourth quarter as a cost-cutting exercise. Other fintech success stories to shed jobs in 2023 included GoCardless with just over 100 job losses.

Job losses extend to struggling Afterpay/Clearpay

And now, to the surprise of nobody as it was trailed last year, Block is kicking off plans to shrink its headcount from 13,000 to 12,000.

Perhaps Jack Dorsey is now going to admit that the 2022, $29bn acquisition of Afterpay was a disaster. He might even go further and acknowledge that Afterpay/Clearpay does not form the basis for a profitable business. The BNPL outfits PRs continue to try and kid and con that everyone has cut up their credit card and moved to BNPL, but actual consumer behaviour says otherwise.

And now, one of the two remaining ASX listed Australian BNPL outfits, Zip, has launched a new service known as Zip Plus. This offers most of the features of a credit card product, including monthly fees and a double-digit interest rate on revolving monthly balances.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe loss-making BNPL outfits must see something in the ‘Plus’ moniker as Klarna has also launched Klarna Plus. So, the outfit that claimed that the credit card was broken, is now relying on a subscription service.

For a mere $9.99 a month, consumers can also subscribe to Afterpay Plus-another subscription service.

PRs continue to spin that BNPL is displacing the credit card

There is a certain irony in what Zip is up to. It claimed that its BNPL product would take market share away from the credit card. Yet now it is relying on a credit card style product, to boost its survival hopes.

Meantime, PR firms acting on behalf of the BNPL outfits continue to spin away the nonsense that Gen Z and millennials prefer to use Buy Now Pay Later compared to using credit cards. ‘Prefer to use’ is of course never evidenced by actual consumer behaviour and spending stats. Spoiler alert-consumers aged 28 to 43 spend far more via credit cards than they do using BNPL.

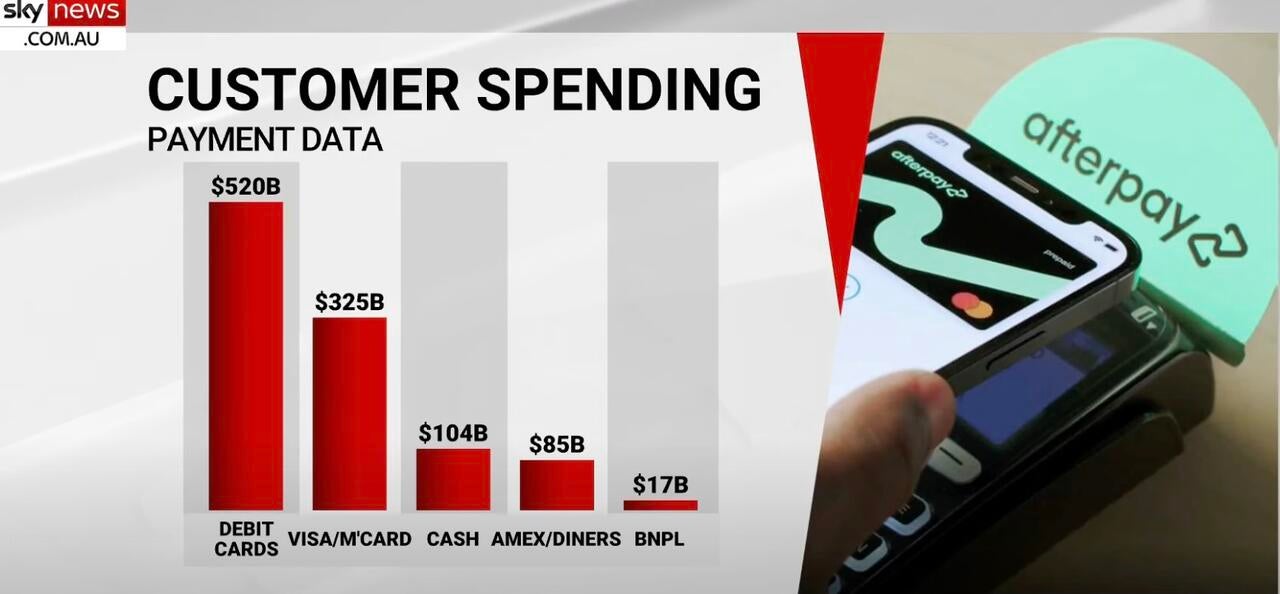

The most mature BNPL market is in Australia and I am obliged to Brad Kelly, MD of Payment Services for the graphic here. He was wheeled out the other day on Sky Australia TV to rubbish very eloquently, the business performance of BNPL using spending stats.

Last surviving Australian BNPL outfits scramble to launch credit cards

Having made the point that Apple will not touch the BNPL market in Australia and that Klarna is a mega failure in that market, he noted that the last 2 remaining BNPL’s outfits are scrambling to launch a credit card.

He added, that after a decade of bluster in Australia BNPL has total annual sales of A$17bn according to the Reserve Bank of Australia. This compares to debits cards at A$520bn, Visa/MC credit cards A$325bn and Amex/Diners charge cards at A$85bn. Even ATM cash beats BNPL with A$104bn. BNPL’s share of retail payments is less than 1% at 0.054%.

BNPL revenue per customer is miniscule

The average Zip customer spends A$145 per month with an average transaction value of A$46. And the average customer uses Zip just three times per month.

Now compare this with the average credit and debit card customer. The average Australian spend on a credit card is A$1,600 per month and a customer uses it 16 times in a month on average.

The average Australian spend on a debit card is $1,015 with a customer using it around 20 times per month on average. The BNPL revenue per customer is miniscule at about A$12 per month.

Kelly concludes that the BNPL players need to get into a market urgently with a revolving balance at a high interest rate, to earn some interchange and get customers using their card and to be top of wallet.

He sums it up very neatly: “Zip has no choice but to restructure its products and reprice them in line with legacy consumer finance businesses.”

I have not even touched on the funding challenges that the BNPL outfits will struggle to cope with until interest rates subside. Or the impact of regulation on their business prospects.

Related Company Profiles

Coinbase Global Inc

PayPal Holdings Inc

Stripe Inc

Plaid Inc

Block Inc