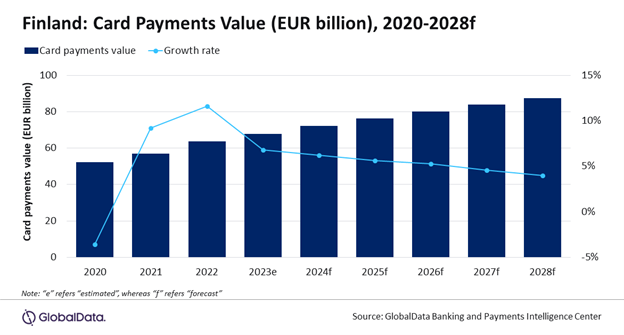

The Finland card payments market is forecast to grow by 6.2% in 2024 to reach €72.1bn ($78.bn), supported by high consumer preference for electronic payments, according to GlobalData, publishers of EPI.

GlobalData’s Payment Cards Analytics reveals that card payments value in Finland registered a growth of 11.6% in 2022, driven by a rise in consumer spending. The value is estimated to have registered a growth of 6.8% to reach €67.9bn ($73.5bn) in 2023.

Ravi Sharma, Lead Banking and Payments Analyst at GlobalData, commented: “The payment card market is well developed in Finland. This is supported by a high level of awareness of electronic payments, high banking penetration (which stands at 99.8% of the adult population), and well-developed payment acceptance infrastructure.

“Finnish consumers are prolific users of payment cards, with frequency of use estimated at 219.7 times per card in 2023, much higher than major developed markets such as the US, Italy, and Germany. This rise is also driven by an increasing preference for contactless payments, supported by the rise in the contactless payment limit.”

Finland has been successful in promoting financial inclusion, as is evident from its nearly 100% adult banked population

The advent of fintech and digital-only banks such as Revolut and Alisa Bank is also supporting the rise in banked population. Since the start of its operations in April 2022, Alisa Bank grew its customer base to 57,500, as of December 2023. High financial inclusion resulted in higher card penetration, which in turn contributed to the overall card payments’ growth.

The transition from cash to cards is evident in the expanding number of POS terminals with 26,933 POS terminals per 1 million individuals in the country in 2023. Incentives including rewards programs and discounts for card payments and the growing popularity of contactless all combine to create a robust card payment ecosystem.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe rise of contactless cards and increased retailer acceptance is significantly boosting electronic transactions, marking a shift towards digitalisation. As per the Bank of Finland, contactless payments accounted for 60% of all the card payment transactions in 2022 compared to 59% in 2021.

Sharma concluded: “Finland is among the most mature countries when it comes to card payments. The shift towards digitalisation is facilitated by widespread familiarity with electronic payments, almost fully banked population, and a well-established POS infrastructure. The Finland card payments market is forecast to grow at a compound annual growth rate (CAGR) of 4.9% between 2024 and 2028 to reach €87.3bn ($94.3bn) in 2028.”