Digital lending fintech FASTA has teamed up with Mastercard to launch the first virtual Mastercard credit card in South Africa.

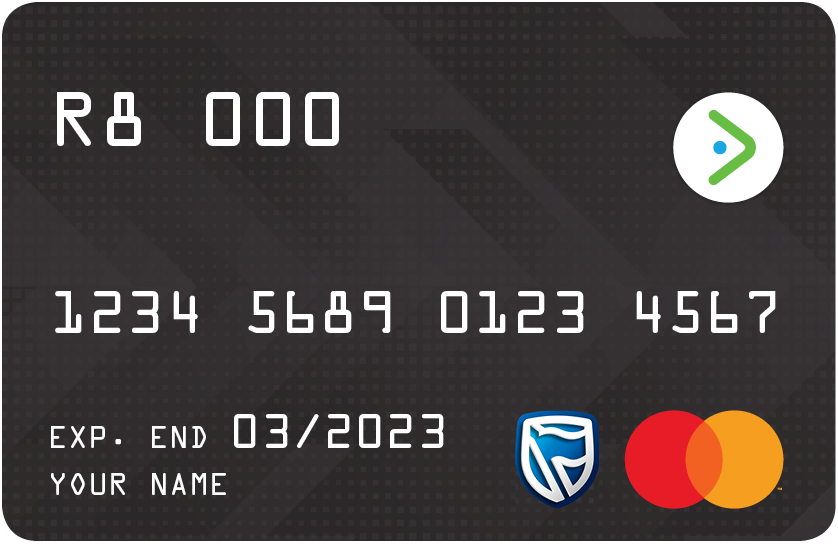

Dubbed FASTACard, the new solution offers access to instant credit up to ZAR8,000 ($474.58) that can be used online and in-store.

Cardholders can pay for goods and services at millions of online and in-store merchants around the world.

The card can be added to apps like Uber and Netflix, used for e-commerce shopping and for a suite of services like data and bills.

The card also supports Samsung Pay, SnapScan, VodaPay or any Masterpass-enabled digital wallet from major banks.

While purchasing in-store, cardholders can use their mobile phone to scan a QR code and pay at checkout.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe virtual card can be used at nearly 200,000 retailers and billers in the country that accept Masterpass – a digital wallet offered by Mastercard.

The FASTACard comes with a 16-digit card number, security code and expiry date.

FASTA CEO Kevin Hurwitz said: “With the virtual Mastercard, we are giving our customers the convenience of being able to spend their credit at millions of Mastercard retail locations in South Africa and around the world.”

Mastercard South Africa country manager Suzanne Morel said: “The new virtual card means that consumers no longer need to use their primary bank card for online shopping.

“It also provides them with additional security and control as they select the exact amount they want to load onto the card for their purchase.”