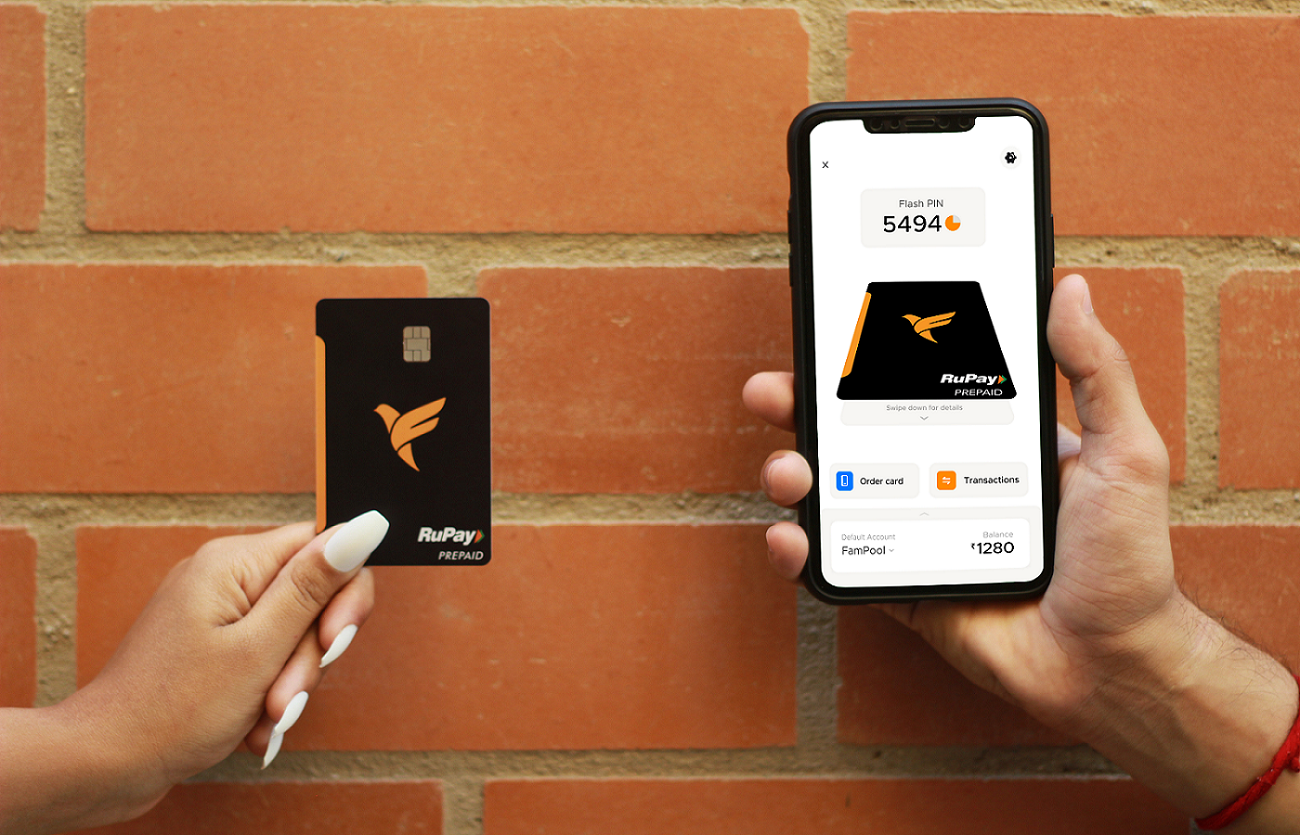

India’s first neobank for teenagers FamPay has launched the first numberless debit card for minors in the country.

The new ‘FamCard’ allows teenagers to make online and offline payments without needing a bank account.

Since it is numberless, the card details are stored in the FamPay app. This removes the need to refer to physical cards for entering card details while transacting online.

Cardholders can also use the FamPay app to pause or block their debit card in case the card gets lost or stolen.

The bank claims that every transaction is secured with fingerprint, Face ID, pattern lock or PIN authentication.

FamPay co-founder Kush Taneja said: “FamCard has a special feature of ‘Flash PIN’, which is dynamic and is generated for every transaction.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Teens can just flash this PIN to the cashier for offline payments, without the need of entering the PIN by themselves on the POS machines.”

The new card has been pioneered by the National Payments Corporation of India (NPCI) and has been launched in partnership with IDFC Bank.

FamPay also tapped the local debit and credit card issuer RuPay, allowing FamCard users to transact at merchant locations that accept RuPay.

In addition to the numberless card, FamPay is also providing teenagers with access to the Unified Payments Interface (UPI) network.

The cardholders will receive their own unique UPI ID, through which they can transfer money across multiple bank accounts in a real-time basis.

NPCI MD and CEO Dilip Asbe said: “With FamPay’s numberless card, the young entrepreneurs are thinking beyond traditional ways of banking and bringing true innovation in payments.

“The power of RuPay and UPI comes together to offer an innovative consumer solution.”

Customers can set up their account on FamPay app and order the card after completing the online KYC of both parent and teen.