Ukraine’s economy was severely affected by the global financial crisis of 2008 and the political crisis of 2013-2014, which had a significant impact on the banking industry.

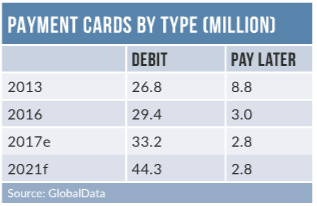

As a result, over 90 banks were declared insolvent between 2014 and 2017. The payment card market was also affected, with the total number of cards in circulation remaining largely unchanged between 2013 and 2017.

The Ukrainian government has taken several initiatives to foster banking sector growth in the form of financial inclusion programmes, payment infrastructure modernisation, and the adoption of technologically advanced payment cards. The efforts led to a rise in Ukraine’s banked population, with the population aged 15 or above with a bank account standing at 62.5% in 2017 – up from 49.0% in 2013. The government has also introduced restrictions on use of cash for individuals and businesses, to reduce dependence on cash and promote electronic payments.

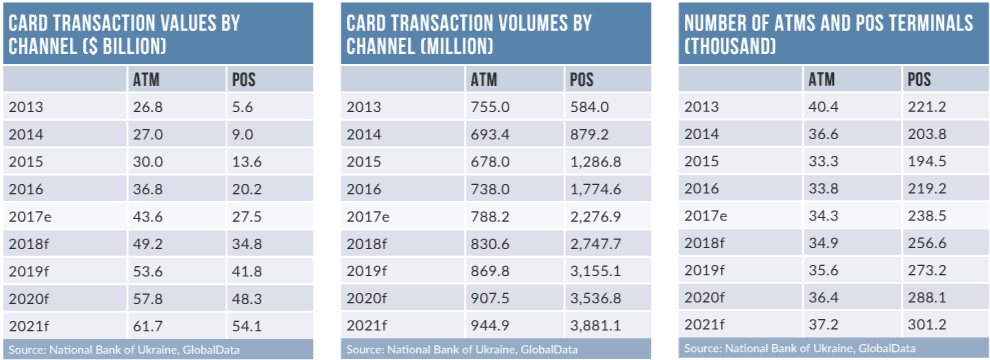

Banks are also encouraging card use through reward programmes, discounts and cashback offers. Debit cards dominate the payment card market, accounting for 96.6% of the total card transaction value in 2017. However, their use is mostly restricted to ATM cash withdrawals rather than payments, with ATM transactions accounting for 61.1% of total debit card transaction value. This implies that Ukrainian customers are more comfortable making payments with cash. Increased financial awareness, restrictions on cash and rising card acceptance are helping boost debit card payments. The introduction of contactless cards will also support this trend.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataElectronic fund transfers by card are popular in Ukraine, with domestic scheme Prostir, as well as Visa and Mastercard, offering card-to-card fund-transfer services. Visa offers Visa Direct, which allows Visa card holders to transfer funds to other card holders using the 16-digit card number. Transfers can be carried out via ATMs, mobile phones, online and POS terminals. Similarly, Mastercard offers the MoneySend service, which allows card holders to make fund transfers using the recipient’s mobile number.

E-commerce in Ukraine registered significant growth from UAH19.6bn ($693.7m) in 2013 to $2bn in 2017 at a CAGR of 29.9%. Rising internet and mobile penetration and growing consumer preference for online shopping supported this. Ukraine’s largest bank, PrivatBank, responded by launching the PrivatMarket marketplace in April 2016. Ukraine’s card acceptance network is growing.

According to the NBU, by September 2017 the number of businesses accepting payment cards had increased by 13.1% compared to the beginning of the year. In 2015 the Kiev Municipal State Administration introduced contactless payments on the city’s subway, enabling passengers to pay with Mastercard cards.