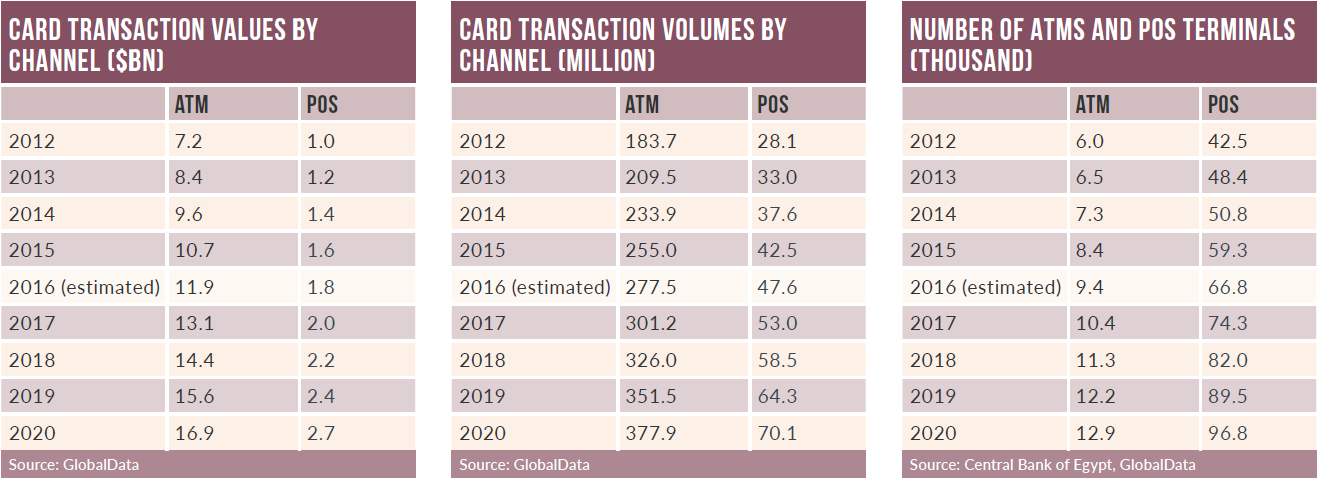

Egypt remains very much a cash-driven society, with it accounting for 95.7% of the overall payment volume in 2016. Cash is mainly used for low-value payments in both rural and urban areas

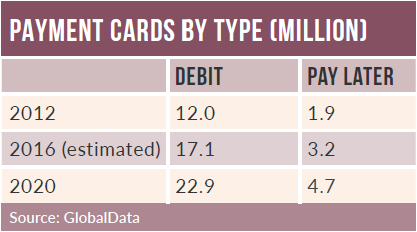

Payment card penetration in Egypt stood at 22.6 cards per 100 individuals in 2016, the lowest in comparison to its peer countries such as South Africa, Morocco, and Kenya.

Factors driving the low penetration include the large unbanked population and a lack of financial awareness. With the government working to improve financial inclusion and financial infrastructure, use of payment cards is expected to increase between now and 2020.

Debit card penetration in Egypt stood at 19.1 cards per 100 individuals in 2016, lower than peer countries South Africa with 90.2, Morocco with 37.4, Kenya with 24.4, and Nigeria with 22.0.

The Central Bank of Egypt, however, has made efforts to promote payment cards. In collaboration with the Ministry of Finance, it launched a project in 2011 to pay the salaries of five million government employees directly into bank accounts. The project aims to reduce administration costs and keep money in the financial system. According to the central bank, new government departments are being added to the project every year, resulting in a rise in the number of bank accounts and debit cards held in Egypt. National Bank of Egypt, Banque Misr, Housing and Development Bank, Banque de Caire, and Arab African International Bank are project participants.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn November 2016, the central bank issued new regulations permitting banks to deploy agents, which can offer all types of banking service, establish customer relationships, and verify customers’ identities. This is anticipated to support growth in the debit card market.

Egypt’s credit card market is still in early stages of development, with a penetration rate of just 3.5 cards per 100 individuals in 2016. Penetration remains low primarily for religious reasons, as Islamic law forbids the charging of interest. Fear of falling into debt, and low merchant acceptance are other key factors.

Strict guidelines for credit cards have also contributed to the low adoption. Banks are cautious when issuing cards and require details of income and credit history, and impose age limits. However, issuers are offering reward programs, interest-free credit periods, flexible repayment options, low minimum payments, free supplementary cards, and a range of insurance services to drive uptake.

Strict guidelines for credit cards have also contributed to the low adoption. Banks are cautious when issuing cards and require details of income and credit history, and impose age limits. However, issuers are offering reward programs, interest-free credit periods, flexible repayment options, low minimum payments, free supplementary cards, and a range of insurance services to drive uptake.

Despite limited financial literacy and payment infrastructure, and a large rural population, Egypt’s e-commerce market grew significantly between 2012 and 2016, from $1.2bn (EGP22.5bn) to $3.1bn, at a review-period CAGR of 25.6%. The market is anticipated to reach $6.6bn by 2020.

Cash on delivery remains the preferred mode of payment, accounting for 62.0% of the total e-commerce transaction value in 2016. However, with a growing young population and improved infrastructure and technology, payment cards are gaining traction, accounting for 20.3% of the total e-commerce value in 2016.