India’s long-awaited Cryptocurrency and Regulation of Official Currency Bill, set to be discussed by the government next week, aims to ban the trading of most cryptocurrencies in India and initiate the adoption of a central bank digital currency (CBDC) in the country.

While it still needs to be voted in, news of the bill caused the crypto market to tumble on the Indian crypto exchange platform, WazirX. If approved, this bill will ban the trading of most cryptocurrencies in India with the exception of certain cryptocurrencies, while allowing the Indian government to use blockchain technology to develop its own CBDC. The cryptocurrency bill is the first step toward ensuring that India can introduce its own CBDC without any competition.

The regulation of the cryptocurrency sector has been an ongoing debate in India. One of the government’s initial initiatives to regulate the sector came back in 2018, when the Reserve Bank of India (RBI) prohibited banks from engaging in any cryptocurrency transactions. This ban was later revoked by the Supreme Court. Due to the lack of regulations, the cryptocurrency sector has been able to operate for many years, gaining popularity among many people with an estimated 15 million cryptocurrency owners investing approximately $5.4bn in cryptocurrencies.

The bill, initially due to be addressed in early 2021 but delayed until now, would introduce a framework making any non-government-issued cryptocurrencies illegal while legalizing CBDCs. This move was motivated by the government’s decision to launch a pilot test of its own CBDC in early 2022. By banning private cryptocurrencies, the government can limit the impact this sector could have on the economy.

With already $6.6bn in cryptocurrency accumulated by a portion of the population, it could represent a critical volatility risk exposure for the country’s economy if more funds were to be added into the cryptocurrency market. The new framework should help prevent the accumulation of funds into an unregulated and highly volatile market. In addition, cryptocurrencies are a decentralized technology that will challenge the government’s control on the economy if they become widely adopted.

The bill mentioned that some cryptocurrencies will be exempt from the ban, but no further details have been provided regarding this. Some cryptocurrencies that could benefit from exemption are stablecoins. Unlike other cryptocurrencies, stablecoins are more stable as they are pegged to fiat currencies: USD Coin, one of the most popular stablecoins, is pegged 1:1 to the US dollar. Although stablecoins are supposed to be more secure than cryptocurrencies, regulations still need to be introduced to ensure that they are actually backed by liquid funds. Tether, the largest stablecoin, has attracted the attention of regulators, who requested evidence proving that each coin was fully backed. Tether’s report from June 2021 reported that only 10% of its coins were backed by cash and bank deposits.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe bill should also provide a framework on India’s strategy to develop a digital currency. India is currently conducting research on the feasibility of launching a digital currency and the impact it will have on financial intermediaries. The RBI is planning to conduct its first pilot test in early 2022. A digital currency should enable the RBI to simplify the access to funds to its population, in particular for those who live in remote areas and do not have access to a bank account.

With a reported mobile penetration of 85% according to GlobalData’s Macroeconomic Indicators, the launch of a digital wallet giving access to digital currency would be the most effective approach to promote among its population. Unlike cryptocurrency, the government’s digital currency will allow it to monitor transactions and identify illicit activity such as tax evasion and financial crimes.

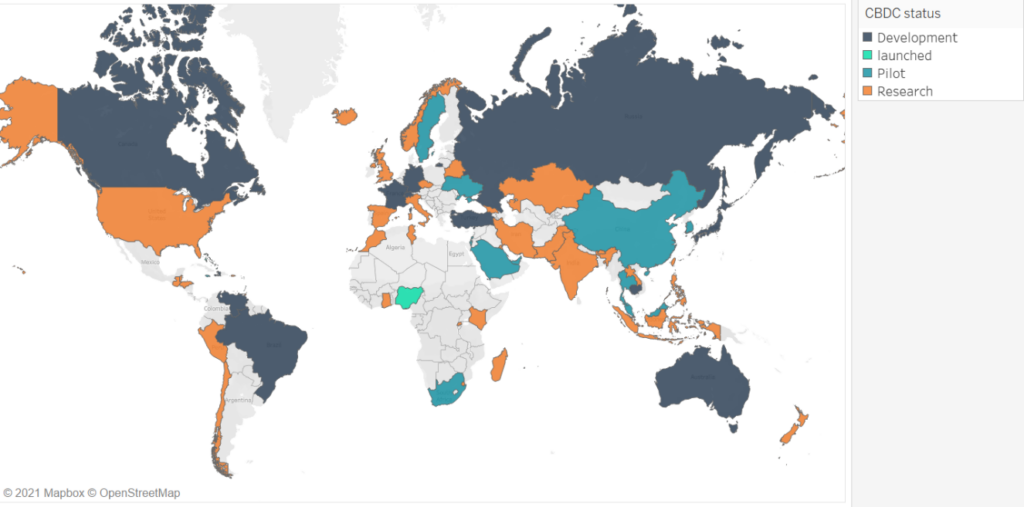

Status of CBDC in the world and India

India is currently conducting research on developing its own digital currency and is planning to conduct a first pilot test in early 2022.

India is not the only country looking to regulate or ban cryptocurrencies while allowing blockchain technology. There are some similarities between the bill proposed by the RBI and the one passed by the Chinese government. Both are banning cryptocurrencies while allowing the development of blockchain technology. Through the ban, China is removing any competition to its digital yuan, which is meant to be launched in 2022. China will become the first major economy to launch a digital currency. Further regulations by other countries should also be expected next year.

The timing of India’s cryptocurrency ban is very likely to precede the pilot test of the country’s own digital currency. While the ban is likely to impact cryptocurrency exchange platforms based in India, there is no guarantee that it will stop people from trading and automatically adopting the government-issued digital currency. Peer-to-peer cryptocurrency platforms are harder for the government to monitor as they offer a certain degree of anonymity to users. The government may discover that banning cryptocurrencies is not enough to prohibit people from using them.