Small and medium-sized businesses are increasingly conducting their business globally. Mastercard’s 2023 borderless payment report states that 50% of SMBs are doing more business internationally than in 2021. In the cross-border payments space, many providers are already capitalising on this market opportunity. Payoneer saw a notable 39% annual growth in its B2B accounts payable/accounts receivable (AP/AR) sector, which now represents more than 10% of the company’s total volume. Meanwhile, Wise‘s business revenue has experienced a significant 56% increase year-over-year, surpassing its personal segment’s 47% growth.

With the rapid growth of digital challengers, established FX providers are racing to match the more efficient, cost-effective, and user-friendly promises of competitors to capture market share in the SMB space.

The importance of user experience

In this competitive landscape, user experience has emerged as a key differentiator. According to a report by Swift, 61% of SMBs will not return to a provider if their payment process is not as seamless as advertised. In other words, businesses are increasingly looking for solutions that are not just financially advantageous but also simple and easy to use.

Because businesses tend to hold accounts with more than one provider, clunky or counterintuitive experiences can leave FX providers with a substantial number of inactive or minimally engaged customers, adversely affecting average revenue per customer, and ramping up pressure on new customer acquisition.

Defining what makes a positive user experience is not always easy to place. However, research shows that accounting integrations are high on the list of importance for business customers, because of the convenience they provide. Swift’s research ranks integrations as the third most important driver for SMEs when choosing an international payment provider. Likewise, Equals Money’s Chief Product Officer, James Simcox, says accounting integration is their most requested feature.

Swift’s research also shows that for SMBs, transparency and security are top of the list in importance, so if FX providers can cement those two purchase drivers as fundamentals of the business, adding accounting integrations could help propel the business to the next level.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIntegrating cross-border payments with business operations

The term ‘accounting integration’ can refer to many different workflows in the context of cross border payments. In Codat’s experience working with providers like Currencies Direct, Fexco, Nium, and more, there are two specific solutions that stand to have the greatest impact on user experience.

Automating payment runs

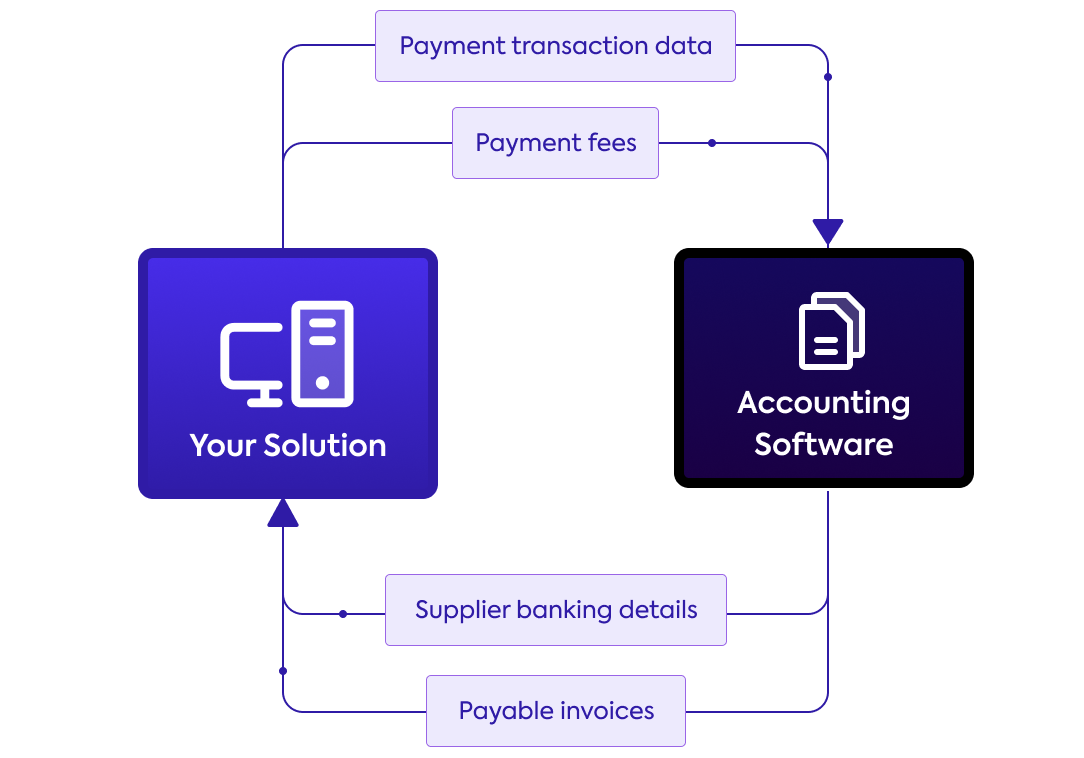

Research shows that when it comes to making payment runs, accounts payable teams are frustrated by the process of uploading supplier payment details, which is often done using spreadsheets. If one figure or space is out of place, they must start the whole payment run again. Extracting supplier payment details and data on unpaid bills directly from the accounting or ERP system allows AP teams to select and pay bills all within the same portal, while limiting the potential for user error.

Streamlining post-payment reconciliation

The task of documenting foreign currency transactions in financial ledgers, which can be cumbersome for finance teams, is often overlooked by providers of cross-border payment services. This issue becomes even more complex when dealing with multiple currencies, especially for businesses that handle a high volume of transactions, which are typically the most crucial clientele for these providers.

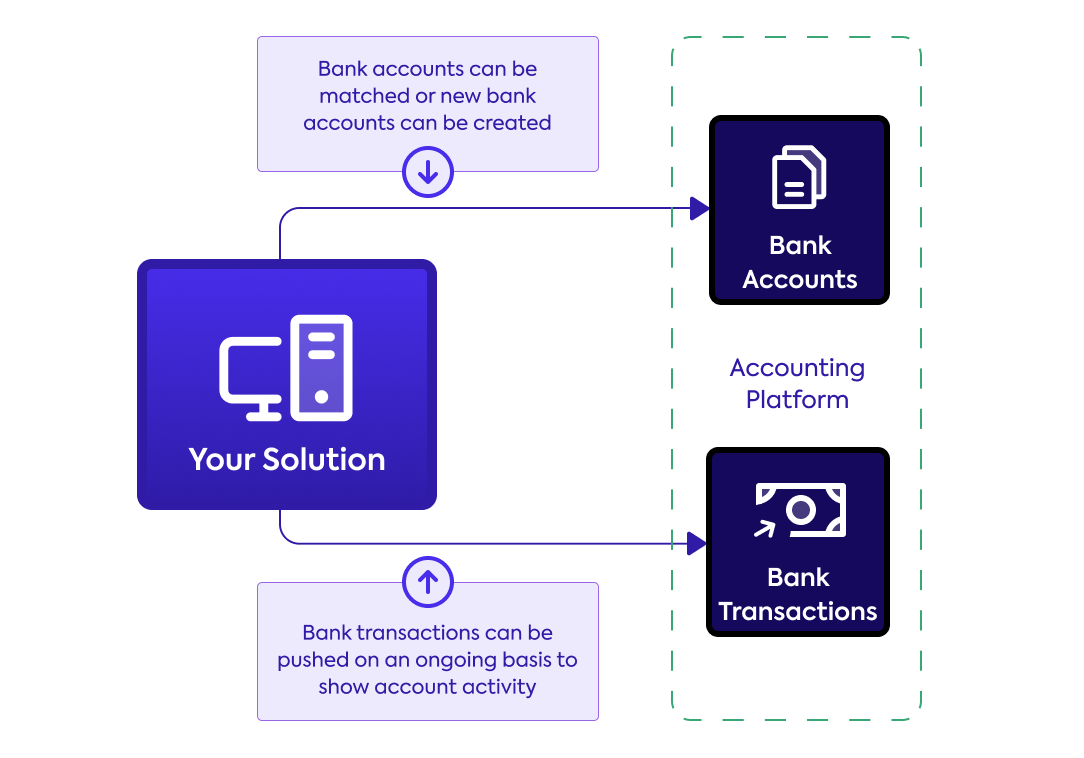

The introduction of a bank feed — an automated flow of transaction data from the payment provider to the customer’s accounting software — can greatly ease this burden. This feed ensures that all vital transaction information, including the amount, date, involved parties, and payment reference, is directly fed into the customer’s accounting system, streamlining the reconciliation process.

The road ahead in cross-border payments

As trends towards digitisation continue, expectations of business customers around user experience are only going in one direction. The significance of accounting software integration in this equation is underscored by the adoption rate among leading FX providers. In the venture-backed category of venture-backed of FXC Intelligence’s top cross-border payment providers, more than 40% prominently feature integrations with accounting software on their websites.

As we look to the future, it’s evident that the integration of payment services with business accounting software is not just a trend but a fundamental shift in how B2B payments are managed. Those in the FX and payments space must continue to innovate and adapt to meet the evolving demands of businesses. The ability to offer seamless, integrated solutions will likely be a key determinant of success in this increasingly competitive market.

Jonathan Burrell is VP of Product at Codat