As one of Europe’s most mature and well-developed payments markets, the UK is highly competitive and attractive, with contactless and alternative payments flourishing. However, the likely impact of Brexit will not be clear for at least a couple of years, and small sections of the population remain financially underserved.

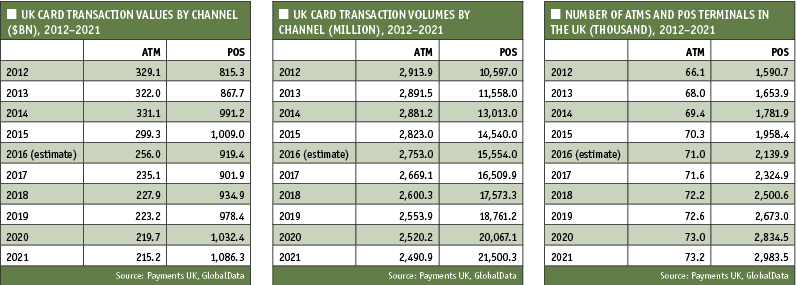

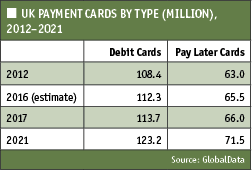

The UK’s payment cards market is one of the most mature, highly competitive and attractive in Europe. Pay later and debit card penetration rates per inhabitant stood at 1.0 and 1.7 respectively in 2016. In terms of transaction value, the market accounted for 19.7% of Europe’s total, while in terms of volume it accounted 19.2%.

New banks such as Atom Bank, Fidor Bank, Tandem Bank and Starling Bank are attempting to differentiate themselves by being either online- or mobile-only operators. With cashless transactions surpassing cash in 2014, the emergence of these banks will accelerate the shift away from cash.

Impact of Brexit

Impact of Brexit

The UK’s vote to leave the EU is likely to impact the payments industry over the forecast period (2017–2021). There will be no immediate effect on payments policy and regulation – current payments regulation deriving from the EU will remain until any changes are agreed by the UK and the EU.

Brexit’s impact on GDP and the financial market is likely to spread to consumer lending and retail spending, leading to falling revenue in the payments industry.

While the industry’s prospects will depend on the success of the Brexit negotiations, growth in card transactions will continue, driven by the shift to contactless payments.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataGovernment efforts to serve the unbanked

The UK government is developing programs to better serve the unbanked population. One initiative is an agreement between the government and the UK banking industry to offer basic bank accounts free of charge.

Initiated in January 2016, basic accounts can be obtained by individuals who do not have a bank account, are ineligible for a standard current account, or who cannot use their existing account due to financial limitations. Banks must also provide standard services to these account holders.

Increasing adoption of contactless

Contactless cards were first issued in the UK in 2003, and numbered 102.4m in 2016. The volume of contactless transactions also rose, from 25.6m in 2012 to 1.1bn in the first half of 2016. The number of contactless card transactions rose by 194.2% annually in August 2016.

A key driver of contactless payment has been public transport. The emerging mobile and wearable NFC payment markets are also expected to support growth.

The ease of making low-value contactless payments has made consumers and retailers more open to technology. To further encourage these payments, the UK Cards Association raised the spending limit from $31.5 (£20) to $47.9 from September 2015.

Alternatives gain prominence

A growing preference for secure electronic payments, growth in the young population, and deeper smartphone penetration saw banks, payment service providers and telecoms companies launch new solutions to gain market share.

Sweden-based mobile payment provider Seamless launched the Seqr mobile app in the UK in October 2016, in association with GoCardless. Tesco Bank launched its PayQwiq m-payment solution in November 2016, allowing users to make in-store payments by scanning a QR code.

Google launched Android Pay in May 2016, with support from Bank of Scotland, First Direct, Halifax, HSBC, Lloyds, M&S Bank, MBNA, Nationwide Building Society, NatWest, RBS, Santander UK, TSB and Ulster Bank. Apple launched Apple Pay in July 2015, and the launch of Samsung Pay in 2017 will stimulate market competition.