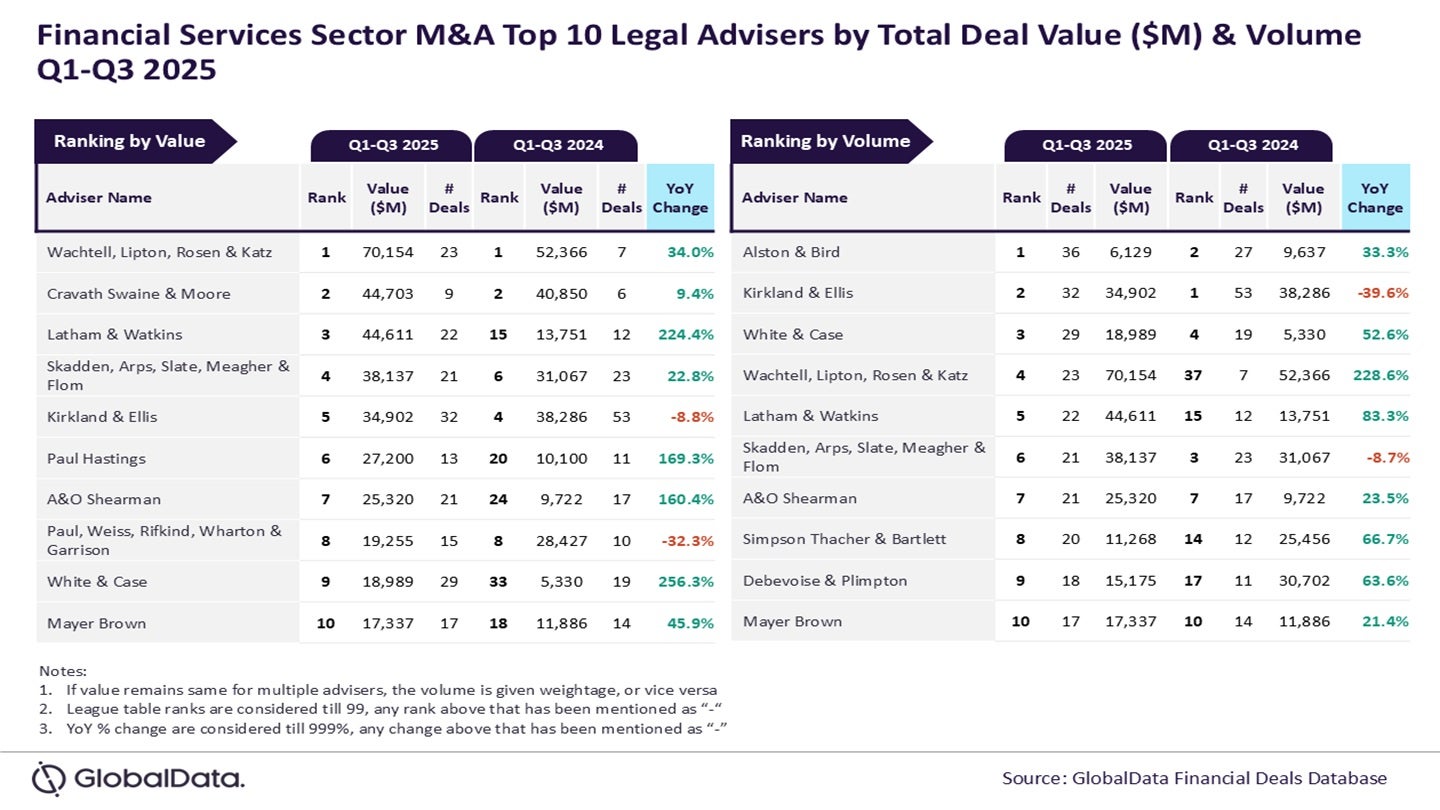

Wachtell, Lipton, Rosen & Katz and Alston & Bird have emerged as the top mergers and acquisitions (M&A) legal advisers by deal value and volume, respectively, for the first three quarters (Q1-Q3) of 2025 in the financial services sector.

This ranking is based on a comprehensive league table report by GlobalData, a prominent data and analytics firm.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

An analysis of GlobalData’s financial deals database shows that Wachtell, Lipton, Rosen & Katz secured the top spot in the deal value table by advising on transactions amounting to $70.2bn.

Alston & Bird claimed the top place in the deal volume table by participating in a total of 36 deals.

GlobalData lead analyst at GlobalData Aurojyoti Bose said: “Wachtell, Lipton, Rosen & Katz was the top adviser by value during Q1-Q3 2024 as well. It not only led by value but was also significantly ahead of its peers. The involvement in three mega deals, of which two were valued more than $10bn and one valued at more than $20bn, played a pivotal role for it to secure the top spot by value during Q1-Q3 2025.

“Meanwhile, Alston & Bird registered improvement in the total number of deals advised by it during Q1-Q3 2025 compared to Q1-Q3 2024, Resultantly, its ranking by volume also improved from the second position to the top position during the review period.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe runner-up in the value category was Cravath Swaine & Moore, which guided deals worth $44.7bn.

It was closely trailed by Latham & Watkins with deals totalling $44.6bn, Skadden, Arps, Slate, Meagher & Flom with $38.1bn, and Kirkland & Ellis with $34.9bn in advised deal value.

In the volume category, Kirkland & Ellis claimed the second spot with 32 deals. White & Case followed with participation in 29 deals, Wachtell, Lipton, Rosen & Katz with 23, and Latham & Watkins with 22.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.