Accelerated changes in payments have made quick adaptation more critical than ever. SmartStream’s Santosh Tripathy argues that players must approach the fast-moving marketplace with a sober mixture of speed and control marketplace control

Digital Payments have been very vibrant over the last decade and continues to grow in volume and variety. The pandemic has only acted as a catalyst, with a report from Mckinsey suggesting it has pushed the payments industry ahead by a decade. The maximum change recorded is in the growth of contactless payments.

Mastercard revealed in its report that 66% of transactions in the UK are contactless. The trends continue to be in the space of Instant Payments, Open Banking, Blockchain, e-Wallets, Contactless Payments, and Central Bank Digital Currency (CBDC) initiatives.

Talking about open banking, according to LearnBonds, there are over 10,000 financial institutions around the world with open banking implementations.

Another perspective to that is more than 87% of countries have already established some form of Open APIs in the banking industry.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn the MENA region, we are now seeing the first trend setters such as the Open Banking Regulation in Bahrain. DIFC FinTech Hive is also pushing FinTech innovation and collaboration in the wider financial industry.

The Kingdom of Saudi Arabia and the United Arab Emirates are leading the way when it comes to instant payments, encouraging banks to start supporting new capabilities by the end of 2020 and early 2021.

A very interesting trend in addition has been inception and growth of domestic/regional card networks globally.

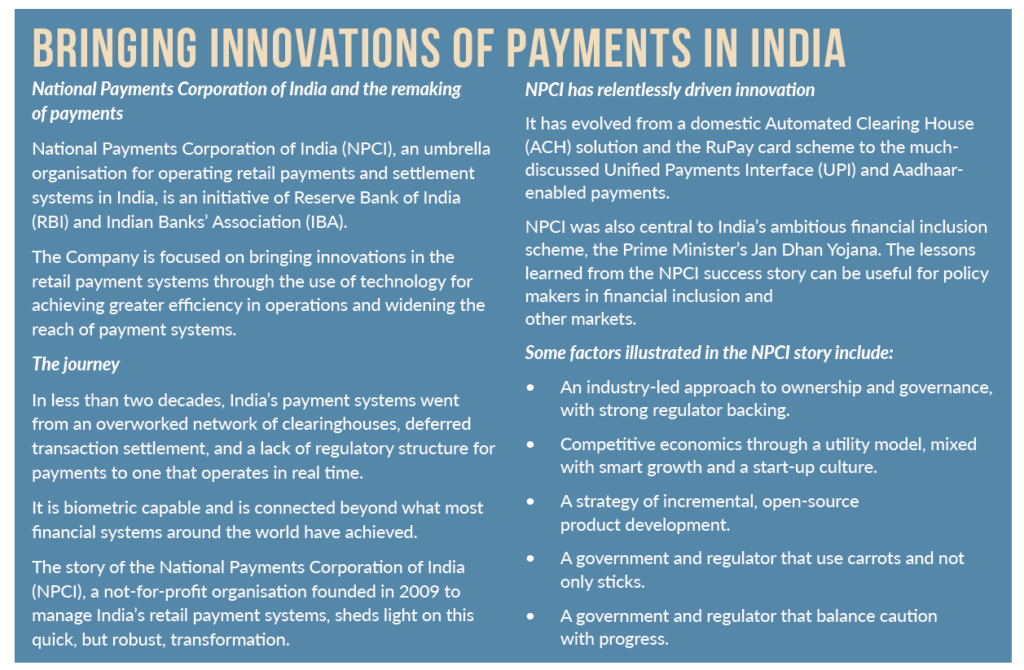

The National Payments Corporation of India (NPCI) has launched its international subsidiary NPCI International to take its hugely popular Unified Payments Interface (UPI) and card network RuPay to international markets.

Sixteen banks from Germany, France and three other eurozone countries are working on a ‘truly European’ payments system that shall act as a rival to global card networks Mastercard and VISA.

Central Banks globally are not only pushing and adapting to real-time payments and open banking, some of them are exploring the feasibility and benefits of CBDC. Singapore MAS has successfully completed phase 5 of the Project Ubin as part of same initiative.

Digital Payments touch lives of millions on a daily basis and has transformed the banking and financial industry.

Our digital payments practice is collaborating with all the payment participants to create innovative solutions to support them in this exciting journey.

Waking up to surprises

Industry-wide reports suggest that there has been a sudden spike in growth of digital payments especially contactless payments, during the last six to nine months. But that was not the only surprise for

the industry.

This summer’s Wirecard AG scandal that ultimately led to the collapse of the European processor also hit the spirit of the payments industry very hard.

It was not the first time and won’t be last unless proper controls, checks and balances are implemented in the operations. Reconciliations and associated functions in the operations cannot be seen as a set of tasks for regulatory and audit purposes.

The payments industry and regulators have slowly started to take cognisance in the lack of investments and innovations in the operations and control space.

The Prudential Regulation Authority (PRA) has started a consultation paper to discuss how to supervise and manage new and growing Non-Systematic UK Banks. PRA has noticed that many of these new banks have underestimated the development required to become a successful and established bank.

Often, they fail to appreciate the ongoing need to invest in systems and controls to ensure they remain commensurate with the evolving needs of the business.

Inefficiency in operations control has shocked the payments industry time and again with its ill effects causing financial and reputational risks for payment companies.

The industry has estimated a loss of $31bn on account of chargebacks and disputes.

The silver lining is in the resilience the payment industry has shown to handle a sudden surge in volumes, with greater collaboration between payment participants.

It would be important that the industry doesn’t lift the foot off the pedal and stay consistent to efforts of streamlining the operational framework.

Technology and relevant solutions are available that can be leveraged immediately to plug in the gaps and bring efficiency. Innovations in Artificial Intelligence (AI) and Machine Learning (ML) could not have come at more opportune time.

Towards a profitable growth

There is lot of exuberance about the growth in volumes of digital payments. While it is encouraging, it also calls for better planning and preparation to sustain this level of growth.

Adoption of cloud technologies, harnessing the power of AI & ML, revenue optimisation and to implement efficient operations control have all featured as a means to achieve it in my conversations with business leaders at payment companies.

Financial Institutions have shown better openness and keenness around adoption of cloud. Cloud is now part of core strategies of almost all of the payment participants and rightly so.

Adoption of cloud has helped organisations rationalise costs, increase flexibility and scalability and most importantly

increase efficiency.

That in combination of big data, cloud computing and analytics has helped payment companies understand their customers better and forge stronger relationships with them.

The next generation of solutions are designed to be cloud native so that they can be deployed as microservices.

The innovations in artificial Intelligence and machine learning will drive the next level of growth and efficiencies

for payment companies. The key here is to find the use cases that are best suited, and tailor made to their roles

in the payment ecosystem.

The technology is maturing as we speak and organisations are trying to understand AI & ML beyond academics. The success would be a result of true collaboration between the payment companies and solution providers that solve

their use cases.

It’s also prudent for payment companies to track the revenue leakage and profitability ratios. The industry relies heavily on the service fee and commissions for their services in the value chain.

The payment ecosystem is cluttered with products and services that financial institutions can offer. However not all of them are profitable and Institutions know that. What they are not aware of is if they are being charged correctly by the service providers and aggregators and whether a particular product is profitable for them.

The competitiveness of the space has forced payment companies beyond their gut feeling and to start using data and science to corroborate their beliefs.

It has prompted the COOs to ask for the operations control framework that offers mechanisms to address this long-standing issue but often ignored challenge.

The rapid increase in velocity, volume and variability of transactions has put substantial stress on the back-office operations team. Instant payments adoption, Open Banking and ISO 20022 migration shall keep financial

institutions resources absorbed. We have seen a lot of pragmatism by a section of payment companies who have leveraged the expertise of established solution and service providers.

Outsourcing of operations has allowed payment companies to focus on the growth of their businesses without the worry of operations being a bottleneck.

The boardroom conversations at payment companies now revolve around means to achieve sustainable and profitable growth.

Technology is going to be at the core of innovations in the payments space and so is efficient and holistic operations control. Speed has given payment companies the growth and effective control mechanisms which should

help them sustain it.

As one of the key players in the ecosystem, we offer a holistic approach to all back-office operations through our solutions and services especially in the emerging areas of digital payments, cross-border payments and digital

transformation initiatives.

The sole vision is to help our partners achieve operational excellence by bringing a frictionless and seamless experience to the entire operations.

Santosh Tripathy is the practice lead for Digital Payments at software and managed services provider SmartStream.