In an increasingly connected world, consumers and businesses expect more than just fast payments. David Chance, VP of strategy and innovation at Fiserv, looks at the market opportunities offered by Request to Pay

Advances in technology have set an expectation for seamless and hasslefree experiences, and promising new developments such as Request to Pay schemes are proliferating worldwide.

Further, Request to Pay, when combined with instant payments and open banking APIs, has the potential to bring new value to the payments ecosystem while reducing friction and cost.

A real-time digital option

Unlike traditional direct debits, Request to Pay transactions are real time, suitable for ad hoc payments, and can be sent and received through multiple channels.

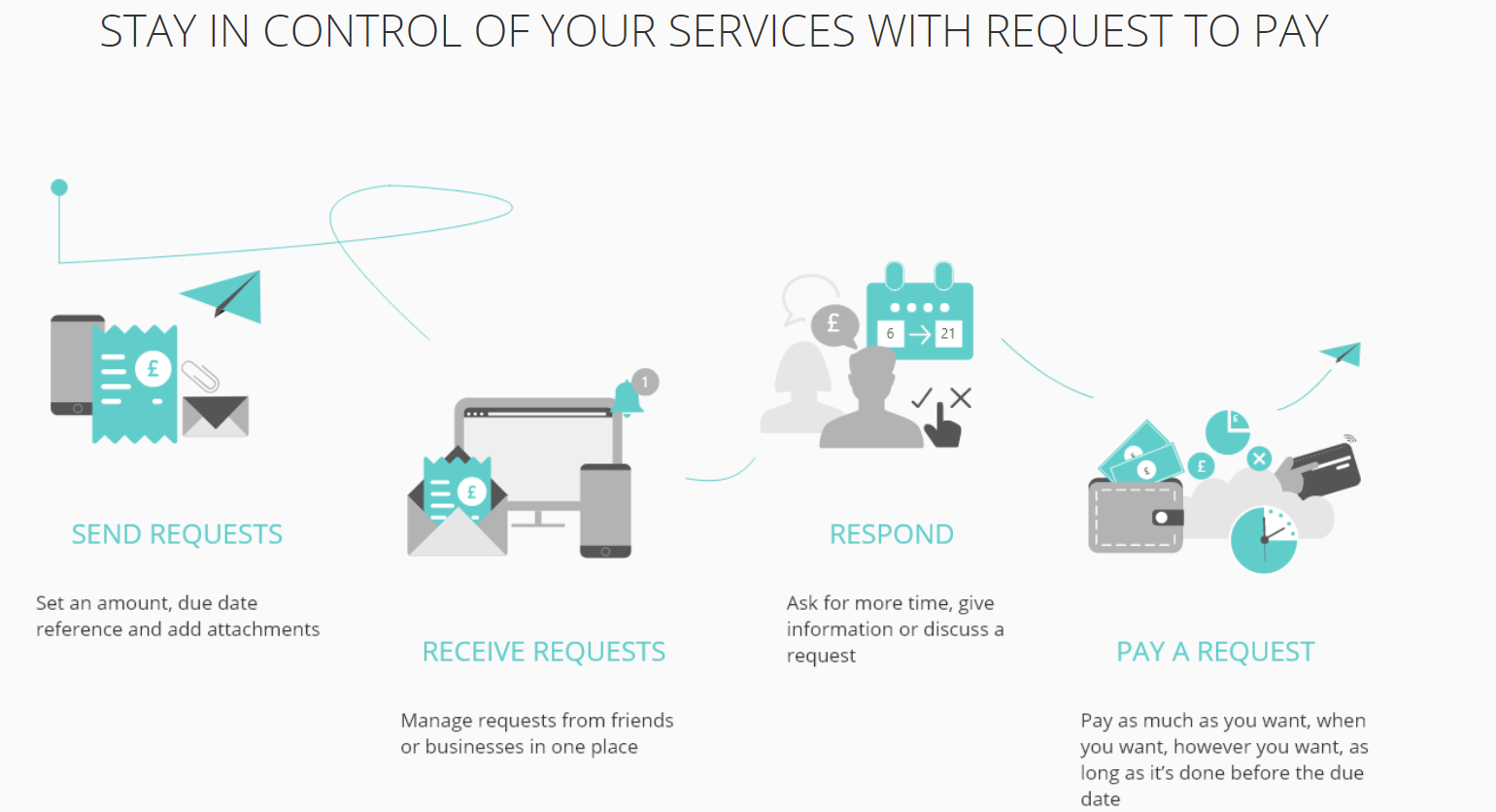

The Request to Pay process is simple, flexible and information-rich. A provider of goods or services (the payee) sends a digital request for payment, accompanied by an invoice or other transaction detail, to a payer. When the request is received, most likely through an electronic interface such as a mobile app, the payer can approve and initiate payment. The payer can also reject the payment, provide alternative instructions, or indicate when a payment will be made in the future.

On its own, Request to Pay is a convenient way to pay and be paid, but the combination of Request to Pay, instant payments and open banking have transformational potential. Together, they can change the way businesses and consumers transact and interact.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataA better experience for merchants and consumers

With Request to Pay, merchants have more control of the payment element of the transaction. The request can be sent at a time

of their choosing, they receive funds directly at the point of handover and can offer a range of innovative solutions to attract and retain customers. For example, offering loyalty points could encourage use of Request to Pay and keep customers coming back.

Because the payment request is embedded in the payment initiation device, such as a digital wallet, API or a smart meter, Request to Pay saves time and effort for consumers, as a bill or invoice can be received, paid, tracked and stored all in one place. For recurring payments, consumers can set up agreements in the same way they would a direct debit or pre-authorised debit agreement.

Request to Pay also improves communications between consumers and businesses. Whether executing an online or in-store transaction, full details about the items included in a purchase, along with details about taxes, guarantees and delivery, can be included with the request.

A true opportunity for forward-thinking financial institutions

Request to Pay offers several operational benefits to financial institutions. As a realtime, direct-to-bank payment option, it has the potential to further reduce check and cash use while complementing non-bank cards and person-to-person payments.

With the right technology, financial institutions can use the rich data that accompanies a request to pay to help mitigate fraud, make credit decisions and understand the cash flow and liquidity needs of customers.

The ultimate success of Request to Pay is dependent on overlay services that combine Request to Pay with instant payments and open banking APIs to create more flexible, convenient and secure payments. For example, the value of a digital wallet grows when it is directly connected to a bank account for instant, low-cost payments. Savvy financial institutions will brand their Request to Pay service, feature their brand in digital wallets and display it at the POS to increase usage.

Additionally, through integration with their mobile apps, financial institutions can optimise the Request to Pay experience. Integration with fingerprint recognition and other advanced authentication techniques can help reduce friction and increase consumer trust.

Using the rich data inherent in Request to Pay transactions, innovative services can be bundled with Request to Pay offerings to enhance payment experiences and loyalty – with financial institutions ultimately establishing themselves as the trusted party to hold and manage this data.

Future ready

Many financial institutions have already made significant investments to upgrade their general ledgers, payment, credit and fraud systems, because building a solid infrastructure to support real-time Request to Pay schemes is critical.

To ensure that the information-rich Request to Pay messages are tightly woven into the payment messages, combining Request to Pay processing alongside payments processing into a single payment services hub may be a better approach.

Financial institutions that understand the opportunity, embrace innovation and anticipate future possibilities will have a clear market lead. Request to Pay, together with instant payments and open banking, is all set to revolutionise digital payments.