Cash remains the preferred method of payment in Thailand, accounting for 96% of the total payment transaction volume in 2017.

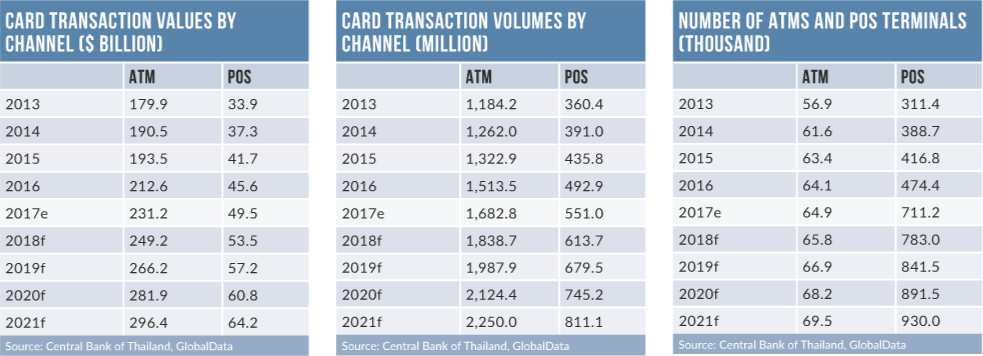

However, card payments are set to increase in popularity as the Thai government and banks strive to provide basic banking services to the unbanked population, improve financial awareness, and expand the POS and QR code-based payment networks.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The central bank has taken a number of steps to create a steady financial environment and drive the country towards a cashless economy. In 2016, it articulated a Three-Year Strategic Plan (2017-2019), focusing on financial and economic stability, and making financial products and services economical and accessible.

In March 2016, the Financial Sector Master Plan Phase III (2016-2020) was launched to help the government, business and retail sectors create an environment and infrastructure conducive to the adoption of electronic and financial payments. Initiatives included developing a robust payment infrastructure, boosting consumer financial literacy, efficient pricing mechanisms, the establishment of an integrated IT system, and industry-wide shared infrastructure and fraud-monitoring systems.

The central bank introduced new regulations in March 2016, requiring all newly issued debit and ATM cards to be chip-based, and existing magnetic stripe cards to be upgraded by the end of 2019. All domestic transactions from the newly issued debit cards must be processed by local debit card scheme provider Thai Payment Network (TPN). For international transactions, banks can co-badge with international scheme providers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

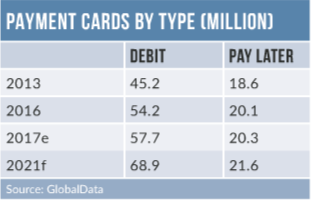

By GlobalDataThai household debt has been high in the last four years, with loans to households from financial institutions accounting for 77.5% of total GDP in 2017. To curb this, the central bank enforced stringent regulations on credit card issuance and personal loans. Effective from 1 September 2017, all banks were required to cap interest rates at 18% per annum, down from 20%. Credit lines for new card holders was also limited in accordance with their monthly salaries, with the aim of helping issuers to identify creditworthy individuals and reduce defaults.

The Thai e-commerce market recorded a CAGR of 30.4% in five years due to rising mobile and online penetration, the growing presence of online gateways, and increased consumer confidence in online transactions. This has attracted international companies to the country’s e-commerce market. Credit cards are the most used online payment instrument, while virtual payment cards and alternative solutions including PayPal, TrueMoney, AirPay, Masterpass, and mPay have also supported e-commerce growth.

Prepaid cards are increasingly gaining acceptance, as Thai consumers tend to prefer to spend within their means.