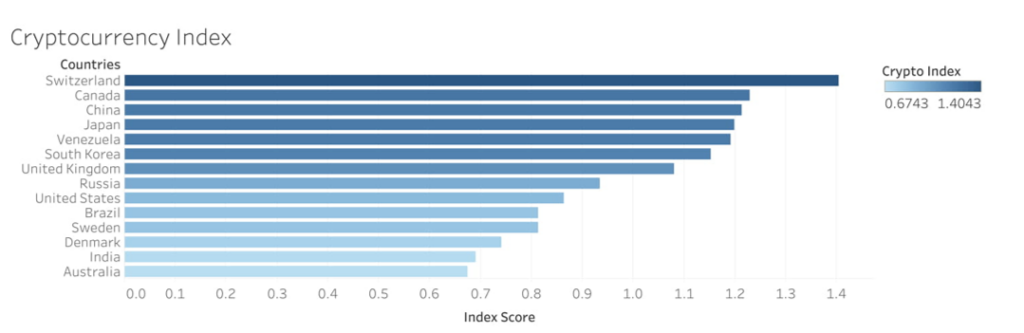

Switzerland is one of the top global markets in terms of blockchain and cryptocurrency development, according to GlobalData’s Cryptocurrency Index, but the likes of China, South Korea, and Sweden are close behind.

In recent years, the cryptocurrency sector has gained a lot of attention from the general public. Governments and corporations are paying it more attention, as some are looking into practical applications of the blockchain technology on which cryptocurrency is built on.

In order to measure how ready some countries are to adopt blockchain technology, GlobalData has developed a Cryptocurrency Index.

The index is a composite of five key indicators that have been identified as important in the adoption of blockchain technology. These are: the country’s regulatory approach to cryptocurrencies, whether the country is developing (or has developed) a central bank digital currency (CBDC), consumer internet access in the country, consumer cash use in the country, and the number of job postings in the area of blockchain and cryptocurrencies within the last year.

The index is designed to measure the readiness level of 14 countries that have been identified as making progress in this sector, either due to their interest in blockchain technology or because of their approach to regulations, benchmarked against the global baseline for the selected indicators.

Increase in digital payments

The increase in digital payments has encouraged some governments to consider going cashless. Blockchain technology can help central banks adopt cashless economies, as it can be used to create digital currencies in place of physical cash.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataA growing number of central banks are working on their own versions of digital currency. Among the countries selected on the index, China ranks lower than Switzerland and Canada because it falls short with its consumer internet access.

GlobalData’s internal system reported that only 59% of the Chinese population has access to the internet, compared to 94% in Canada and 91% in Switzerland. The digital yuan is already being live-tested in selected Chinese cities. Other countries like South Korea and Sweden are currently conducting pilot testing of their digital currency, with the latter aiming to introduce its e-krona in the next five years.

The decline in cash usage in some countries felt like a natural step to transitioning to a CBDC – particularly in Sweden, where cash usage is in sharp decline.

According to Riksbank, only 9% of Swedes used cash to complete transactions in 2020. Despite this, Sweden is not high on the cryptocurrency index because of the lack of regulation in its cryptocurrency sector, but its ranking is expected to improve in the coming years.

“Digital currency will benefit governments”

With the decline in cash usage, the introduction of a digital currency will benefit governments, as it allows them to keep track of money within the system and thus reduce the amount of tax loss due to undeclared revenue.

CBDCs provide financial inclusion to the most vulnerable in society who cannot afford a bank account. The Financial Conduct Authority published a report estimating that 1.3 million British adults don’t have a bank account. In order for a government to provide access to a digital currency, it needs to have a strong internet penetration in its country.

Along with conducting their research on digital currencies, governments are also working to better regulate cryptocurrency and blockchain technologies. These are positive signs for companies that can confidently invest in this technology and recruit talents.

GlobalData’s internal system reported 306 blockchain job postings in index leader Switzerland over the period of April 2020 to April 2021. Companies are comfortable investing in blockchain technology in Switzerland because the government passed a law in favor of cryptocurrency and blockchain through its Blockchain Act.

The key indicators of the cryptocurrency index give us an understanding of how close some countries are to adopting blockchain and transitioning to a cashless economy.

CBDCs are still at an early stage in many countries, but we can expect to see them go live in countries like China and Sweden within the next five years.

China is striving to adopt its own CBDC due to its low cash use, regulation in favor of blockchain innovations, and ongoing live tests of its digital yuan. It will take longer for Sweden to adopt it, as its regulatory developments are lagging despite its low cash use and widespread internet availability.

This was written by GlobalData payments analyst Chris Dinga.